2020 was an unusual year for the economy. While the UK slipped into its biggest recession in centuries, millions of people had their wages paid by the government, and many more lost their jobs, UK house prices rose at the fastest level since 2004 and the Dow Jones index hit a new record high.

2020 was an unusual year for the economy. While the UK slipped into its biggest recession in centuries, millions of people had their wages paid by the government, and many more lost their jobs, UK house prices rose at the fastest level since 2004 and the Dow Jones index hit a new record high.

So, as a vaccine shows us a path towards the end of the pandemic, what can we expect in 2021? Read on for some expert predictions on what the next year holds, and what you can expect from Altura in the twelve months ahead.

The economy will recover – but it could take time

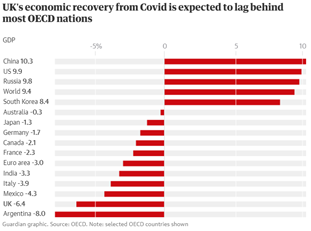

The latest report from the Organisation for Economic Cooperation and Development (OECD) says that the UK economy will bounce back in 2021, but that the recovery will lag behind every other major economy apart from Argentina.

The latest report from the Organisation for Economic Cooperation and Development (OECD) says that the UK economy will bounce back in 2021, but that the recovery will lag behind every other major economy apart from Argentina.

In its latest economic outlook report, the OECD said it expected the UK economy to contract by 11.2% in 2020, compared with the 10.1% fall in GDP it was forecasting last September. The OECD also sharply downgraded its forecasts for UK growth in 2021, from 7.6% in September to just 4.2% and warned the UK economy would still be 6% smaller compared with its late-2019 position by the end of 2021.

The Bank of England has also warned that tougher lockdown restrictions than anticipated would also result in weaker UK growth well into the first quarter of 2021. The Bank said in November that it expected Britain’s economy to slide into a double-dip recession in the fourth quarter of 2020, and that it expects gross domestic product (GDP) to contract by a little over 1% in the final three months of the year.

This would mean GDP for 2020 would be 11% lower than 2019, marking the biggest recession in 300 years.

Other experts are more bullish about the UK’s prospects.

In December, economists at Goldman Sachs upgraded their forecasts for UK GDP growth in 2021 and 2022. The investment bank expects the economy to grow by 7% next year and 6.2% the year after. And, according to forecasts compiled by the Treasury, the median private sector forecast for GDP growth in 2021 is 5.7%.

House price predictions for 2021 vary wildly

Despite the restrictions on movement in place for much of the year, UK house prices rose significantly in 2020.

According to Halifax, the average price of a UK home started the year at £239,927, dropped back towards £237,000 after the first lockdown, then reached £253,243 by the winter. Between the end of June and the end of November, prices experienced the fastest five-month gain since 2004.

Property portal Rightmove said that asking prices rose almost 7% in 2020 and predicts a further 4% increase in 2021.

Rightmove believes that moving home will remain top of the agenda for many people, who have reconsidered their housing needs in the wake of the pandemic, often searching for larger homes with a home office and outdoor space.

The property website expects a busy start of the year as the Stamp Duty holiday deadline approaches. While the tax break is due to expire at the end of March, Rightmove said underlying demand and cheap borrowing costs were unlikely to dampen activity.

Other experts are less optimistic. Savills expect house prices to remain stable across the UK in 2021 while Halifax says that it expects UK property values to fall by between 2% and 5% this year, fuelled by rising unemployment and the end of the government’s Stamp Duty holiday.

The lender said that the impact of the Covid-19 crisis on household finances had been delayed by supportive government policies such as the furlough scheme, but as these schemes are scaled back, unemployment will rise. This, in turn, will pile pressure on the property market after sharp price rises in 2020.

Russell Galley, Managing Director at Halifax, said: “While the economy should begin to recover in 2021, helped by the roll-out of Covid vaccines, the jobs market will inevitably adjust to the changes in demand that are occurring, and unemployment is expected to rise. With the Stamp Duty holiday also due to expire in March – and lower levels of demand – housing market activity is likely to slow.”

Altura plans

Even against a backdrop of challenging conditions, Altura enjoyed a strong end to 2020, with record months for business levels in both September and October. We’re aiming to continue this momentum into 2021, and our plans for the next twelve months include:

- Putting in place a best-in-class digital platform for our clients and advisers through a new, market-leading Customer Relationship Management (CRM) system

- Launching a new specialist lending proposition for commercial, development and other B2B finance solutions

- Significantly growing our adviser numbers, both directly under the Altura brand, and by offering terms as appointed representatives of Altura to selected firms we want to work with

- Enhancing our website and marketing with a range of new guides for different types of borrowers, including first-time buyers, Buy to Let and high net worth mortgages

- Growing our introducer base by securing arrangements with IFAs, financial planners, wealth managers, accountants, and solicitors

- Confirming a senior level hire with significant operational and business development experience, to help us grow the business.

It promises to be a positive year for Altura, and we look forward to keeping you abreast of our progress in our regular updates.

Get in touch

To find out more about working with Altura, please get in touch. Email [email protected] or call us on +44 (0) 20 3786 7270.