In a decisive and historic victory, the Labour Party has won the 2024 UK general election with a significant majority. Keir Starmer has become the UK prime minister after 14 years of Conservative government.

In a decisive and historic victory, the Labour Party has won the 2024 UK general election with a significant majority. Keir Starmer has become the UK prime minister after 14 years of Conservative government.

With the party pledging to hit the ground running, what could a Labour administration mean for the mortgage and property markets? Read on to find out more.

Interest rates are likely to fall soon

One piece of good fortune the new Labour government will benefit from is that there will likely be a cut in interest rates within their first few weeks of office.

With inflation having finally reached the Bank of England (BoE) target of 2%, 63 out of 65 economists polled by Reuters believe the BoE are likely to cut interest rates at their next policy meeting, in August.

This will reduce the cost of borrowing for any mortgage borrower on a tracker deal, and many lenders will likely reduce their standard variable rate (SVR) in line with a base rate reduction. Businesses will also benefit from cheaper borrowing.

While you won’t immediately benefit from any cut if you’re on a fixed-rate mortgage, this could help you secure a cheaper mortgage deal when you come to next take out a home loan. With many commentators expecting the BoE to cut interest rates again later in 2024, and in 2025, cheaper deals could be just around the corner.

Labour has set ambitious housebuilding targets

To tackle a property shortage, Labour has pledged to ensure that 1.5 million homes are built over the next five years.

The party wants to allow local authorities to earmark more green belt land for homes, beginning with brownfield sites and then a new category of “grey belt” – pockets of green belt land that are not nature-rich and beautiful, but scrubby and unloved.

Other planning policies the new government have outlined include:

- Reintroducing mandatory local housing targets scrapped by the Tories

- Giving planning powers to combined authorities

- Funding additional planning officers for councils

- Publishing new design codes, to try to raise the quality of what gets built.

These proposals to free up the planning system were good news for housebuilders, with Persimmon, Vistry (formerly Bovis), and Barratt shares all rising more than 3% the day after the election.

Halifax has predicted that property values are likely to rise modestly through this year and into 2025, reports the BBC, while some mortgage brokers have suggested that the resolution of the election campaign could boost the market.

Nicky Stevenson, managing director at national estate agent group Fine & Country, said: ”Overall, there is room for cautious optimism for the rest of the year and the property and financial markets will benefit from a decisive majority for the government, as opposed to the instability that could have loomed with a hung parliament.”

More support for renters

As part of their housing plans, Labour aims to prioritise the building of new social rented homes and better protect the existing stock.

The party has also promised to abolish section 21 “no fault” evictions and to empower renters to challenge unreasonable rent increases.

A pledge to help first-time buyers

One key pillar of the Labour manifesto was to help more young people onto the property ladder.

They say that they want to “give young people first dibs” on new housing developments and introduce a permanent Freedom to Buy mortgage guarantee scheme.

This permanent mortgage guarantee scheme will help prospective homeowners who struggle to save for a large deposit, and Labour says their plans would support 80,000 young people to get on the housing ladder over the next five years.

Elections don’t significantly affect the housing market

One interesting fact to consider is that general elections have not historically had a significant impact on the housing market.

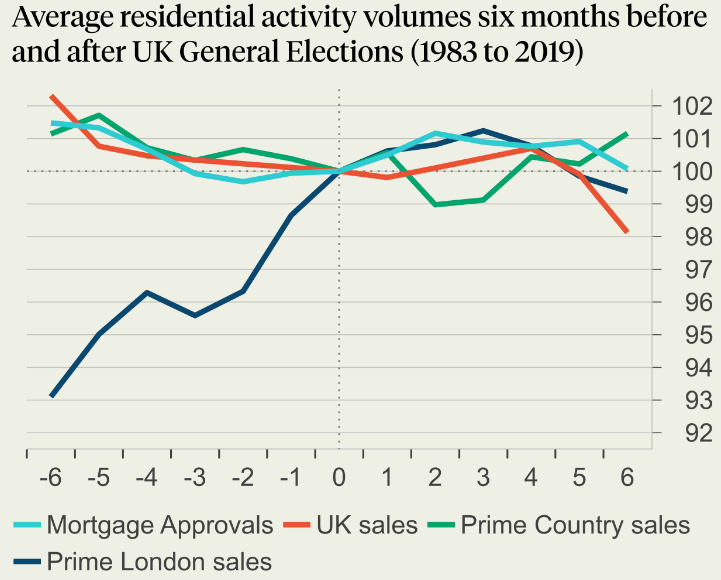

The chart below shows the number of transactions across the UK in the prime country and prime London markets in the six months before and after each election since 1983.

Source: Knight Frank

Source: Knight Frank

If you assume that 100 sales took place during the election month , you can’t see any significant impact from the election. After the election transactions tend to continue as before in all markets.

Knight Frank also says that, even when considering a timelier indicator such as mortgage approvals, “there doesn’t seem to be an obvious impact from general elections on activity”.

Get in touch

If you’re thinking of buying a home this year, or your mortgage deal is coming to an end and you’d like to explore your options, please get in touch.

Email [email protected] or call us on +44 (0) 20 3411 0079.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.