This autumn, Halifax reported that UK house prices had hit a record high – surpassing the post-Covid “race for space” of mid-2022. The average property price has reached a record high of £293,999, with prices going up by 3.9% on average in the year to October 2024.

This autumn, Halifax reported that UK house prices had hit a record high – surpassing the post-Covid “race for space” of mid-2022. The average property price has reached a record high of £293,999, with prices going up by 3.9% on average in the year to October 2024.

Moreover, the Guardian reports that house prices in the UK grew at the fastest rate in nearly two years in November. Nationwide reported that the annual growth rate rose to 3.7% in November from 2.4% in October.

With the Bank of England (BoE) having cut interest rates twice in recent months, could more affordable mortgages drive further property price growth in 2025? And will interest rates continue to fall as inflation falls back towards the BoE target?

Read on for some expert forecasts for interest rates and house prices in 2025.

Interest rates are expected to fall to around 3.5% by the end of 2025

The BoE has cut the base rate twice in the second half of 2024 – once in August from 5.25% to 5%, and then to 4.75% in November.

Additionally, Office for National Statistics (ONS) data shows that inflation was 1.7% in the year to September, the first time it has been below the BoE’s 2% target since April 2021.

With the inflation rate having fallen to below 2% in the year to September, policymakers voted to cut the cost of borrowing at the most recent meeting.

If inflation remains under control, interest rates will likely continue to fall in 2025.

However, the ONS reports that, in the year to October 2024, increased energy costs saw inflation rise to 2.3% – above the official target.

And, many analysts believe that likely energy price rises in the new year, coupled with the inflationary nature of Rachel Reeves’ first Budget, mean that inflation may remain above the target in 2025. This could slow the pace of interest rate cuts.

Santander has forecast that the base rate will fall by a further 1% in 2025. Graham Sellar from Santander UK told This is Money: “We move towards a new norm, where base rate not only falls to 3.75% by the end of next year [2025] – but stays between 3% and 4% for the foreseeable future.”

Meanwhile, economists at Capital Economics think the base rate will fall slightly further to 3.5% by early 2026. They had previously forecast that interest rates would fall to 3% by the end of 2025 but have concluded that rates will now fall slower as a result of Labour’s first Budget.

Paul Dales, chief economist at Capital Economics, said: “We already thought that the Bank’s inflation concerns would mean it continues to cut rates by 25 basis points every quarter until mid-2025.

“But in the light of the Budget […] we no longer think the pace of rate cuts will quicken in the second half of 2025 and we now think rates will fall only as far as 3.5% in early 2026 rather than to 3%.”

While many analysts forecast a cut to around 3.5% by the end of 2025, the Guardian reports that Goldman Sachs predicts that the base rate will fall to as low as 2.75%. This would mean that the BoE reduce the base rate by 0.25% at each of their nine meetings from November 2024 to November 2025.

“We remain comfortable with our forecast for consecutive 0.25-point cuts and lower our terminal bank rate forecast to 2.75% in November 2025 (from 3% in September 2025)”, said the investment bank.

House prices set to rise by around 3% in 2025

With Halifax reporting that the average UK house price rose by 3.9% in the year to October 2024, most analysts predict further growth in 2025.

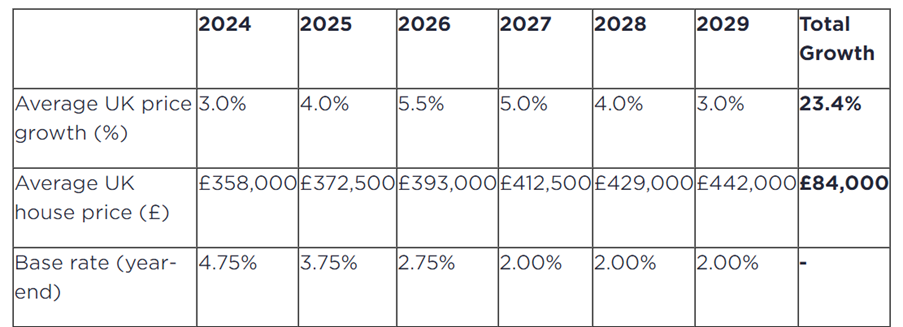

National estate agent Savills also expects the base rate to fall to 3.75% by the end of 2025, alongside a 4% rise in house prices. They then expect stronger growth in 2026 and 2027 so, by the end of 2029, the average property price will have increased by 23.4%.

Source: Savills

However, the agent believes there will be regional differences in property price growth in 2025:

- 2.5% growth – south-west and the east of England

- 3% growth – London and the south-east

- 3.5% growth – Wales

- 4% growth – East Midlands

- 4.5% growth – West Midlands

- 5% growth – Scotland, Yorkshire and the Humber, the north-east and the north-west.

Online property experts Rightmove also forecast that property prices will rise by 4% in 2025.

Tim Bannister from Rightmove says: “The signs are that the market momentum that we’ve been seeing this year will continue into next year, especially if mortgage rates drop to a level that gives greater affordability to some movers who have been waiting in the wings until now.

“The big picture of market activity remains positive when compared to the quieter market at this time last year. This sets us up for what we predict will be a stronger 2025 in both prices and number of homes sold, particularly if mortgage rates fall by enough to significantly improve affordability for more of the mass market.”

Estate agent Hamptons predicts that house prices will rise by 3% across Great Britain in 2025, says Financial Reporter, followed by a 3.5% rise in 2026 and a 2.5% rise in 2027.

The agent says that, by the end of next year, prices in every region should have recovered to their 2022 pre-mini-Budget peaks.

Finally, the Office for Budget Responsibility (OBR) has a slightly more pessimistic forecast. Mortgage Strategy reports that the OBR predicts house price growth to fall back slightly from 1.7% in 2024 to 1.1% in 2025, as the average effective mortgage rate continues to rise.

“House price growth then averages around 2.5% from 2026 until the end of the forecast [2030] supported by nominal earnings growth.”

Get in touch

If you are looking to buy a home or remortgage your property in 2025, we can help. Please get in touch by email at [email protected] or call us on +44 (0) 20 3411 0079.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.