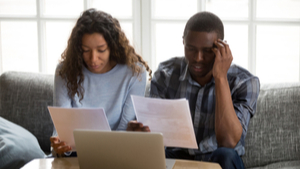

In recent years, fixed-rate mortgages have been overwhelmingly popular with borrowers. Indeed, the Office for National Statistics reports that 86% of UK mortgages are being repaid on fixed rates of

Read our latest articles here on our blog. We comment regularly on mortgages, property and the economy for a range of publications and organisations.