Whether you want control over decision-making, greater earning potential, or simply the flexibility to work to your schedule, running your own business can bring many benefits. Indeed, the latest figures show that there are more than 4 million self-employed people in the UK.

Whether you want control over decision-making, greater earning potential, or simply the flexibility to work to your schedule, running your own business can bring many benefits. Indeed, the latest figures show that there are more than 4 million self-employed people in the UK.

When it comes to your finances, though, you may find life more challenging. Mortgage Solutions reports that 1 in 3 self-employed individuals have never applied for a mortgage, with the main reason for this being that they fear they will be rejected by the lender.

In addition, 1 in 4 entrepreneurs said they believe it’s more challenging for self-employed people to get a mortgage.

The truth is that there are dozens of lenders out there happy to consider mortgage applications from self-employed applicants. However, as criteria can vary sharply between lenders, it can be trickier to find the right bank or building society for your needs.

Read on to discover:

- What a lender considers “self-employed”

- 3 ways a lender might determine what a self-employed person can borrow

- How these different approaches can result in vastly different lending amounts

- Why working with an expert can help self-employed borrowers to navigate the market.

What a lender considers self-employed

Don’t just assume that self-employed people are just sole traders with “income” equating to the money they make.

If you own, and are paid by your limited company, lenders will likely consider you to be self-employed if you own more than 20% to 25% of your company. It doesn’t matter how you pay yourself, or if you own 100% of the business – if you own more than 20% of your business, a lender will say that you have control over the company and, crucially, how you are paid.

3 ways a lender might determine your self-employed income

Different lenders use different methods to determine your income as a self-employed person. This matters for two reasons:

- Some methods of calculating income will result in you being able to borrow more. This could be the difference between securing the mortgage you need and not.

- Finding the right lender could mean you benefit from a more competitive interest rate, reducing your repayments and the interest you pay.

There are typically three ways a lender will determine your income.

1. Your personal income

Simply, your income as a self-employed person is the amount your business has earned minus the amount that you have spent.

If you’re a sole trader, that is generally easy. Your accounts will show your revenue and your expenses, and your personal income is what’s left.

If you’re a business owner or company director, then you may pay yourself a salary (often this will be up to the Personal Allowance and National Insurance (NI) threshold, which is £12,570 in 2024/25). You may then take dividend payments from the profits your company makes, as dividends are exempt from NI and Dividend Tax rates are lower than Income Tax rates.

This is the way that most lenders will determine your income. They will add your salary and dividends together and base their lending on this figure.

2. Your potential income

If the above calculation is sufficient to get the mortgage you need, you’ll likely have a wide choice of lenders to consider.

However, what if you decide to retain some of your profits in the business? This might be money that you could draw if you wanted to, but you decide to leave invested in your firm.

Some lenders take the view that, as you could theoretically take these profits as income, they will include them in any affordability calculations. This could significantly increase your borrowing potential.

3. The value of your contract

Increasing numbers of contractors are paid a day rate according to their contract. Consequently, some lenders have begun to offer mortgages targeted at contractors that use the value of the contract to determine the borrowing available.

For example, if you receive a day rate of £400, a lender may work out your income as:

4. £400 day rate x 5 days a week x 46 weeks a year = £92,000.

Using the value of your contract can help you to maximise the amount of borrowing that is available to you.

The method of income calculation can significantly affect how much you can borrow

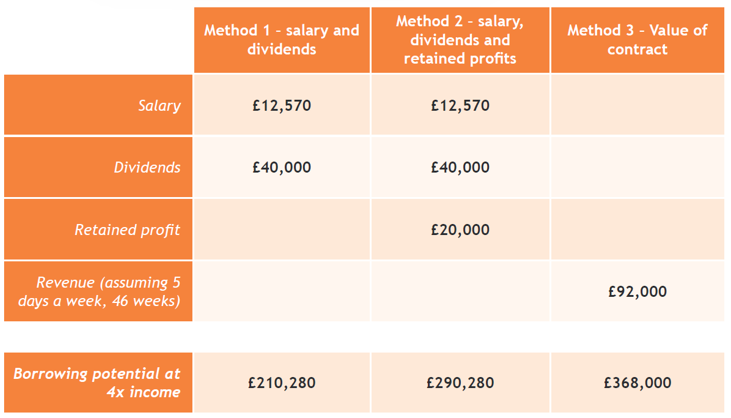

Here’s an example that demonstrates why finding the right lender can make a significant difference to the amount you can borrow.

This example assumes:

- You are a contractor with a day rate of £400.

- Your latest accounts show a net profit of £60,000 after you take a salary of £12,570.

- You decide to take dividends of £40,000 and leave £20,000 retained profits in the business.

As you can see, finding a lender who will include your retained profits, or the value of your contract, can substantially increase your borrowing potential. This could make all the difference when it comes to securing the borrowing you need to buy your dream home.

As you can see, finding a lender who will include your retained profits, or the value of your contract, can substantially increase your borrowing potential. This could make all the difference when it comes to securing the borrowing you need to buy your dream home.

Working with a professional can add real value

As you have read, many self-employed borrowers are deterred from applying for a mortgage as they fear that a lender will reject them. You may even have experienced this yourself.

Lenders treat self-employed applicants in a range of ways, so the key is finding the right bank or building society for your specific needs. Just because one lender won’t agree the lending you need doesn’t mean that they will all feel the same way!

While most lenders are comfortable with lending based on your salary and dividends, there are others who will take a more flexible approach.

When we meet self-employed clients, we always consider all the various ways of measuring income. Only by doing this can we pair you with the right lender to ensure you get both the amount you need to borrow and the most competitive deal available.

Additionally, our wide experience in working with self-employed clients means we can make sure you’re completely prepared and in a great position to move quickly.

For example, one of the advantages of working with Altura is that we can give you advice on how you structure your income well in advance of applying for your mortgage.

If you’re self-employed and you’d like to discuss your mortgage options and how we can help you, please get in touch. Email [email protected] or call us on +44 (0) 20 3411 0079.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.