Back in 2005, the average mortgage term in the UK for a first-time buyer was 25 years. The Office for National Statistics says that the average age of a first-time buyer at that time was 30, and most new homeowners could expect to have repaid their mortgage by their mid-50s, several years ahead of their retirement.

Back in 2005, the average mortgage term in the UK for a first-time buyer was 25 years. The Office for National Statistics says that the average age of a first-time buyer at that time was 30, and most new homeowners could expect to have repaid their mortgage by their mid-50s, several years ahead of their retirement.

Fast forward to 2024, though, and many experts believe that 25-year mortgages have become a thing of the past.

The Guardian reports that, by the middle of 2022, the average mortgage term for a first-time buyer was 30 years. By the end of 2023, almost 1 in 5 first-time buyers were arranging their mortgage over 35 years.

While increasing mortgage terms have helped buyers to afford bigger mortgages, there are risks to taking out a 30-, 35- or even 40-year mortgage. Read on to find out more.

Rising house prices and higher interest rates mean more people are taking longer mortgages

There are two key reasons why more homebuyers are taking longer mortgages:

- Affordability – stretching out repayments over a longer term reduces your monthly mortgage payment.

- Higher interest rates – more expensive borrowing means you may have to spread your repayments over more years to bring the cost down.

Lenders must be able to evidence that you can afford your mortgage repayment. Clearly, this is easier if you take your home loan out over 35 years rather than 25 years.

Here’s an example using the Altura mortgage calculator – if you took a £400,000 capital and interest mortgage on an interest rate of 5% your monthly repayments would be:

- £2,338 over 25 years

- £2,147 over 30 years

- £2,019 over 35 years

- £1,929 over 40 years.

Of course, it is easier to show a lender you can afford a monthly repayment of £1,929 than it is to evidence you can meet a commitment to pay £2,338.

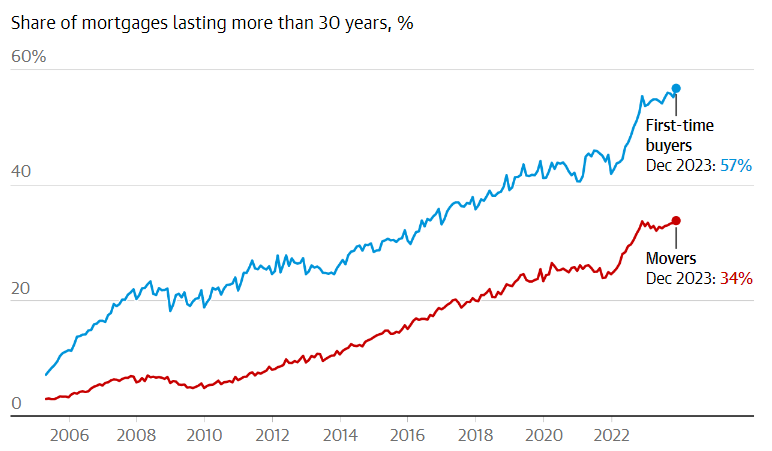

These factors have led to a significant rise in the number of mortgages lasting more than 30 years, as the graph below shows.

Source: the Guardian

Source: the Guardian

In early 2024, UK Finance looked at how affordability issues were challenging for first-time buyers.

- In 2022, the average mortgage term for a first-time buyer in 2022 was 30 years.

- By the middle of 2023, for that buyer to achieve the same affordability – as measured by their monthly payments compared with income – they would have needed to borrow over a 50-year term.

- By December 2024, rising mortgage rates had pushed this to 72 years.

To deal with these affordability challenges, many mortgage lenders will now offer a 40-year term. The Guardian say that, at the end of April 2024, 79% of lenders offered a four-decade term, compared to just 57% a year earlier.

While they can help with affordability, a longer term means you’ll pay more overall

Using the same example above, of a £400,000 capital and interest mortgage at 5%, the Which? mortgage calculator says that the total you will repay over the term of the loan is:

- £701,508 over 25 years

- £773,023 over 30 years

- £847,875 over 35 years

- £925,817 over 40 years.

So, in this example, while extending the term from 25 to 40 years might reduce your monthly repayments by £409, over the term of the mortgage you will pay a staggering £224,309 more in interest.

Longer mortgages could pose a risk to your retirement

While a longer mortgage term could cost you more overall, it could also pose a risk to your retirement prospects.

The BBC reports that, in the final three months of 2021, 31% of new mortgages had an end date beyond State Pension Age.

By the end of 2023, 42% of new mortgages had this end date during retirement, suggesting a rise in the popularity of longer-term loans.

If your mortgage stretches into your retirement, it could pose a risk to your wellbeing. You may have to continue making mortgage repayments from your pension, potentially reducing your disposable income. Alternatively, you may decide to use some of your pension savings to repay any outstanding mortgage, but this could leave you with less money for your retirement.

Review your mortgage term each time you take out a new mortgage

While you may want to choose a longer mortgage term now to ensure your repayments are more manageable, it’s important to review this each time you take out a new home loan.

For example, you may be able to opt for a shorter term in the future if:

- You move home and borrow less

- Your earnings increase and you can afford more each month

- Interest rates fall and bring down the cost of your mortgage.

We can help you to ensure your mortgage is affordable for you, and review it as the term progresses so you can clear the outstanding debt on your terms.

For advice, please get in touch. Email [email protected] or call us on +44 (0) 20 3411 0079.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.