In recent years, changes to regulations and tax laws have led many landlords to exit the *Buy to Let market. From an increase in Stamp Duty to low house price growth, landlords have faced a range of challenges.

In recent years, changes to regulations and tax laws have led many landlords to exit the *Buy to Let market. From an increase in Stamp Duty to low house price growth, landlords have faced a range of challenges.

However, there is still a lot of optimism about the UK property market. Here are five reasons why UK *Buy to Let continues to offer a great opportunity in 2020.

1. *Buy to Let mortgage rates are low

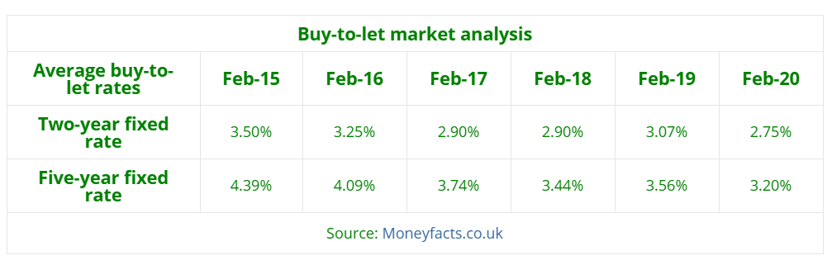

According to the latest data from financial analysts Moneyfacts, the average rates being charged on two and five-year fixed rate *Buy to Let mortgages have fallen sharply in the last year.

Lenders have cut rates on both types of deal by around 0.30% in the last 12 months, making both new mortgages and remortgages cheaper.

Rachel Springall, finance expert at Moneyfacts, said: “Optimism for 2020 appears resilient and lenders are clearly working hard to entice prospective borrowers.”

Over the last five years, two-year *Buy to Let fixed rates have fallen by 0.75% and five-year rates by 1.19%. Strong competition in the mortgage sector and a potential Base rate fall could see rates improve yet further in 2020.

2. Potential for capital growth after the ‘Boris bounce’

Despite negative stories about stagnant house prices, the Nationwide say that, on average, UK house prices rose by 1.4% in 2020.

In certain regions of the UK, house price growth was even more pronounced. The BBC reports that Billingham in County Durham saw property prices rise by 12.3% in 2019, while there was a 9.1% rise in Ilkeston. House prices rose by more than 6% in Blackburn, Southport, Burnley and Bolton in 2019.

A decisive election result may also boost the property market, with many experts suggesting that there could be a 2% or more increase in house prices this year alone – excellent news for property investors.

Experts’ 2020 UK property price predictions

- Simon Rubinsohn, Royal Institution of Chartered Surveyors (RICS) – 2% rise

- Richard Donnell, Zoopla – 2% rise

- Miles Shipside, Rightmove – 2% rise

- Russell Galley, Halifax – 1 to 3% rise

Richard Donnell, Director of Research and Insight at Zoopla, suggests that the more ‘affordable’ cities for property, such as Glasgow, Belfast and Liverpool, could see price rises of around 4% in 2020.

3. Rise in limited company lending

With the final cut in tax relief on mortgage interest coming into force in April, more landlords are choosing to move their properties into a limited company. This is primarily because all costs, including mortgage payments, can be deducted as a business expense. And, any tax due is paid at the corporation tax level of 19% rather than at an individual’s marginal rate.

Additionally, as a landlord, you can draw income from your limited company in the form of dividends. In the 2019/20 tax year, the first £2,000 of dividends is tax-free. You then pay tax on further withdrawals at 7.5% as a basic rate taxpayer or 32.5% if you fall into the higher rate bracket.

The increase in this type of lending has seen a sharp increase in the choice of limited company *Buy to Let mortgage products.

According to Moneyfacts research, there are approximately 875 products that are available for *Buy to Let limited companies, special purpose vehicles (SPVs) or offshore limited companies, up from just 425 deals in 2017.

4. Yields still good in many areas

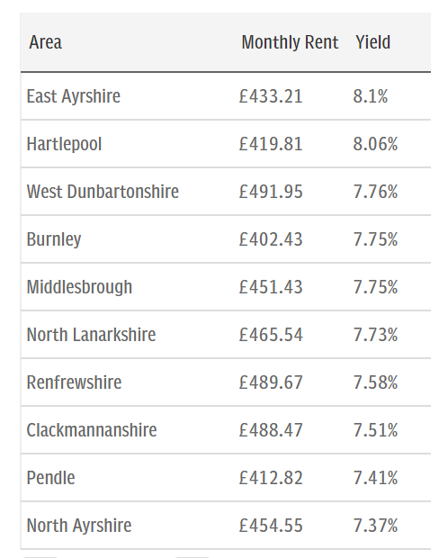

Choosing the right location for your *Buy to Let investment can be key to generating a good rental yield. And, in 2020, there are many locations in the UK which offer excellent potential for income.

Choosing the right location for your *Buy to Let investment can be key to generating a good rental yield. And, in 2020, there are many locations in the UK which offer excellent potential for income.

According to Daily Telegraph research, the highest rental yields can be found in the north of England and Scotland, with East Ayrshire and Hartlepool yielding 8.1%, and West Dunbartonshire 7.8%.

University cities can also be a good place to invest. Analysis by credit experts TotallyMoney of 580,000 properties found that locations with a high student population, such as Nottingham, Liverpool, Manchester and Leeds have some of the UK’s highest rental yields.

Nottingham is top with two postcodes featuring in the top five, with Liverpool in second place.

5. Rents are rising

A 2018 survey carried out by the Royal Institution of Chartered Surveyors (RICS) showed that UK rents are expected to climb by 15% by 2023 as tenant demand rises.

The latest Office for National Statistics figures show that the average private rent paid by tenants in the UK rose by 1.4% in the year to December 2019, and RICS expects rents to rise ‘at a faster pace’ in 2020.

“As the sector continues to struggle with a lack of supply, the RICS survey data suggests rents will rise by 2.5%,” it says. “In London, rents are expected to rise at an even faster pace of 3%.”

Get in touch

If you’re thinking of investing in property in the UK, or you want to get a better deal on your existing mortgage, please get in touch. We’re experts in UK *Buy to Let and can help. Please email [email protected] or call us on +44 (0) 20 3786 7270.