2023 has been one of the most challenging years the industry has faced. The fallout from the ill-dated Liz Truss mini-Budget, soaring interest rates, and ongoing wars in Europe and the Middle East have created uncertainty across global financial markets.

From our perspective, it’s been the ongoing cost of living squeeze and sharply rising mortgage rates that have most keenly affected our clients.

The Bank of England (BoE) has raised the base rate from 2.25% before Kwasi Kwarteng’s Budget to 5.25% today. The consequence of this has been that the Office for National Statistics says that the monthly mortgage repayments for the average semi-detached home in the UK have risen by an eye-watering 61%.

Despite this challenging backdrop, it’s been a year of growth and positivity at Altura. Read on for a summary of all the ways we’ve supported our clients, colleagues, and the community in 2023.

Major awards success at the “Oscars” of the mortgage industry

Each year, the Mortgage Strategy Awards – widely regarded as the “Oscars” of the mortgage industry – recognise the firms doing fantastic work in the sector.

This year, we were thrilled to win the “Diversity and Inclusion Broker Champion” accolade at the awards. This was one of the three awards we were shortlisted for, alongside “Best Mortgage Broker (fewer than eight advisers)” and “Best Broker for Digital Innovation”.

We’re particularly proud of this recognition as we have worked hard over recent years to support underrepresented groups in our sector.

From a hybrid working model tailored to our team, to our director, Rob Gill, being a founder member of the Accrue Network – designed to encourage black representation in the mortgage industry – we have long been a leader in this area.

It was incredibly gratifying for the team to be recognised for their efforts and to pick up the award at the Grosvenor House Hotel from comedian Ellie Taylor.

Launching a new range of specialist services to further support clients

We’re always looking for new ways that we can support our clients with the services that they need. So, earlier this year, we launched Altura Specialist Finance to offer a range of bespoke financing options to both individuals and companies.

There are four key areas where Altura Specialist Finance can assist:

- Bridging finance – We’ll ensure that you secure urgent, short-term financing in a timely fashion, on terms that work for you.

- Commercial property finance – We’ll help your business find a cost-effective solution for purchasing or refinancing your premises.

- Refurbishment and development finance – We’ll help you find the necessary financing in order to transform your property into your dream home.

- Property portfolio finance – We’ll connect you with experienced lenders who are best-suited to help you grow your portfolio.

Applying our extensive knowledge, and links to specialist banks and lenders, our experienced team is uniquely placed to address your specific needs and provide you with the highest quality service.

Head to Altura Specialist Finance to find out more.

Joining forces with The Children’s Book Project to improve youth literacy

This year, Altura teamed up with the literacy charity The Children’s Book Project.

Book ownership has been directly linked with improved mental health among children, while reading fluency itself has a significant impact on children’s successful progression through education.

The Children’s Book Project is a charity that seeks to tackle book poverty and give every child the opportunity to own their own book. This year the charity will gift over 400,000 books to children through their schools and other settings, and Altura have joined forces with this terrific cause.

There are two main ways we’re helping:

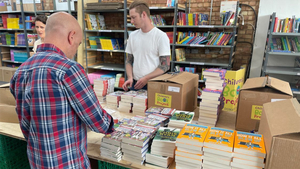

- Volunteering – This autumn, the Altura team spent a day at The Children’s Book Project We sorted and packed around 3,000 books that will soon be on their way to London schools and into the hands of deserving children.

- Donations – In addition to helping the charity pack and distribute books, we’re also contributing to the project for every new mortgage application, protection policy, and general insurance policy we write. We’re also making a donation for every referral we receive from an existing client.

We’re really looking forward to helping the project continue to provide books to children who need them in 2024.

A new mortgage service for employees

For many people, their mortgage is likely to be their biggest financial commitment – and often their biggest worry. So, improving financial wellbeing can boost an individual’s mental health.

This year, we have launched an innovative employee mortgage service aimed at businesses of all sizes.

Free to both the employer and employee, this is a simple and cost-effective way that firms can offer employees an additional layer of financial support. We’ll tailor the level of support to each business, and can help employees:

- Understand their mortgage options, particularly if their mortgage deal is coming to an end

- Obtain the best new deal to manage the “payment shock” of higher mortgage payments

- Get the right mortgage for them if they are moving home and lead them through the process during what many surveys show is one of the most stressful of all life events

- Get onto the property ladder if they are buying for the first time, providing advice and education to help meet this aspiration.

We have a wealth of experience working with businesses and their employees, from small companies to some of the very biggest. We’re really looking forward to working with more firms in 2024 and providing valuable financial wellbeing support.

More great feedback from clients

We’re committed to providing a high-quality service that our clients love. So, it’s been hugely gratifying in 2023 to receive terrific feedback.

We have a five-star rating on Google from more than 70 reviews. Some of the comments that clients have left for us in 2023 include:

- “Rob Gill from Altura is exceptional. Friendly, approachable, and professional. His industry knowledge and contacts meant we could secure the loan we needed. I highly recommend Rob at Altura.”

- “I cannot recommend Altura Mortgage Finance and in particular Kevin Curtis enough. Kevin helped me with a remortgage which became slightly complicated due to circumstances but Kevin was always on hand with advice and solutions. Five-star service. Would definitely use this company again.”

- “We have used Altura Mortgage services for the second time, once for a mortgage then for a remortgage a couple of years later. Rob and his team are incredibly helpful, always available for (oh so many) questions, we cannot recommend enough!”

Head here to read more of our five-star reviews.

Growth in the business

Despite a challenging environment, we’re thrilled to have continued growing the team in 2023.

We’ve added three new advisers to the team – taking the total number to 10 – and we’re on track to increase the business’s revenue by around a third, despite tough economic conditions.

We’re excited about what 2024 may bring, and we’d like to take this opportunity to thank all of our clients and partners for their support this year.

If you have any questions or you’d like to explore how Altura could help you, please get in touch. Email [email protected] or call us on +44 (0) 20 3411 0079.

Please note

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.